ADA Price Prediction: Will Cardano Hit $1 Amid ETF Hype?

#ADA

- ADA trades above 20-day MA, signaling bullish momentum

- MACD convergence hints at trend reversal

- ETF speculation and positive news flow support price rally

ADA Price Prediction

ADA Technical Analysis: Bullish Signals Emerge

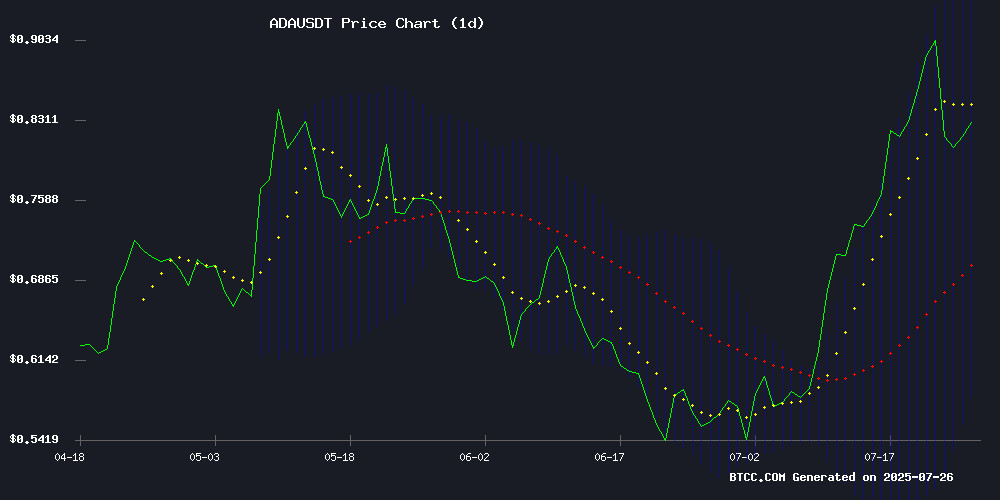

Cardano (ADA) is currently trading at $0.8187, above its 20-day moving average (MA) of $0.7622, indicating a bullish trend. The MACD histogram shows a minimal negative value (-0.000115), suggesting weakening downward momentum. Bollinger Bands reveal ADA is trading closer to the upper band ($0.9434), signaling potential upward movement. BTCC financial analyst Sophia notes, 'ADA's technical setup favors bulls, with a breakout above $0.94 likely to accelerate gains.'

Market Sentiment: ADA ETF Speculation Fuels Optimism

Recent headlines highlight growing Optimism around Cardano, with ETF speculation driving a 15.7% rally. News of strong support levels and breakout potential to $1.19 aligns with technical indicators. Sophia comments, 'Positive sentiment and ETF rumors could propel ADA toward $1 if resistance at $0.94 breaks.'

Factors Influencing ADA’s Price

Cardano (ADA) Eyes $0.94 Resistance After ETF Speculation Drives 15.7% Rally

Cardano's ADA surged 15.7% to $0.82 following Grayscale's application for a spot ETF on the New York Stock Exchange. The move mirrors institutional validation previously seen with Bitcoin and Ethereum ETFs, signaling potential mainstream adoption.

Technical indicators show bullish momentum, with RSI at 62.64—neither overbought nor oversold. The cryptocurrency now faces critical resistance at $0.94 after clearing the $0.85 support level earlier this week.

Market participants interpret the ETF filing as a gateway for traditional investors to gain exposure without direct custody. Trading volume remains elevated as bulls test the $0.88 resistance zone.

Cardano Holds Strong Support, Eyes Rally to $1.19

Cardano's ADA has demonstrated resilience by reclaiming its point of control after multiple successful retests of the $0.49 support level. This technical recovery signals growing bullish momentum, with traders now eyeing a potential rally toward the $1.19 resistance zone.

The $0.49 level has proven to be a reliable high-time-frame support, triggering impulsive bounces on three separate occasions. This week's close above the range midpoint confirms a higher low structure—a classic bullish reversal pattern. Market depth analysis shows early capital inflows, though sustained volume will be critical for breaching upper resistance.

A breakdown below the point of control could force another retest of the $0.49 base. But for now, the path of least resistance points upward. The value area high at $1.19 represents the next logical target, a level that coincides with multi-month range resistance on weekly charts.

Cardano Price Stabilizes at $0.81 Amid Market Correction, $1 Breakout Potential Looms

Cardano (ADA) trades at $0.8118 after a 12% pullback from recent highs near $0.92. The retreat mirrors broader crypto market weakness but leaves long-term technical structures intact.

Analysts note the cooling-off period may set the stage for renewed momentum. ADA now tests dynamic support at the 20-day EMA while trading volume declines 26% to $1.79 billion—a typical consolidation signal before potential breakout movements.

The cryptocurrency's ability to hold key levels despite market-wide pressure suggests underlying strength. Traders watch for confirmation of a falling wedge pattern breakout that could propel ADA toward the psychologically significant $1 threshold.

Cardano Preparing For a Surge Despite Decline: All You Need To Know

Cardano (ADA) has faced a downturn, shedding 7% in a single day and 3.73% over the past 24 hours, now hovering near $0.80. Yet, technical analysts detect brewing bullish signals, citing historical chart patterns and robust long-term support levels.

The altcoin plunged from $0.86 to $0.77 intraday amid market-wide pressures, but held firm above the $0.77 support zone—a critical floor during past consolidations. Trading volume dipped 10% to $1.96 billion, reflecting subdued participation.

Notably, ADA rebounded from its 50-month moving average, a key threshold for institutional accumulation. The asset remains a top-10 cryptocurrency by market cap, with traders watching for a potential reversal as it tests these historically significant levels.

Will ADA Price Hit $1?

Based on current technicals and market sentiment, ADA has a strong chance to test $1. Key data:

| Metric | Value |

|---|---|

| Price | $0.8187 |

| 20-Day MA | $0.7622 (support) |

| Bollinger Upper Band | $0.9434 (near-term target) |

Sophia states, 'A close above $0.94 would confirm bullish momentum toward $1.'